3Q 15 Financial Results

Conference Call

Conference Call

Forward Looking Statement

2

This presentation contains express or implied forward-looking statements within the

Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities laws.

This forward looking statement regarding our future growth, increased volumes and

demand in the markets in which we operate, the roll out of our new All-In-One wireless

platforms, our ability to penetrate the local fleet vertical market, our ability to diversify and

expand our customer base, continuing demand in our defense and aerospace business,

our ability to develop new customer relationships, our ability to meet the needs of our

existing customers, market interest and acceptance of our products, the introduction of

new products and our ability to provide our solutions to different applications, the timing

of pending U.S. federal rulemaking and the impact of the proposed rules on our business

and our future.Such forward-looking statements and their implications involve known and

unknown risks, uncertainties and other factors that may cause actual results or

performance to differ materially from those projected. The forward-looking statements

contained in this press release are subject to other risks and uncertainties, including

those discussed in the "Risk Factors" section and elsewhere in the Company's annual

report on Form 10-K for the year ended December 31, 2014 and in subsequent filings

with the Securities and Exchange Commission. Except as otherwise required by law, the

Company is under no obligation to (and expressly disclaims any such obligation to)

update or alter its forward-looking statements whether as a result of new information,

future events or otherwise.

Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities laws.

This forward looking statement regarding our future growth, increased volumes and

demand in the markets in which we operate, the roll out of our new All-In-One wireless

platforms, our ability to penetrate the local fleet vertical market, our ability to diversify and

expand our customer base, continuing demand in our defense and aerospace business,

our ability to develop new customer relationships, our ability to meet the needs of our

existing customers, market interest and acceptance of our products, the introduction of

new products and our ability to provide our solutions to different applications, the timing

of pending U.S. federal rulemaking and the impact of the proposed rules on our business

and our future.Such forward-looking statements and their implications involve known and

unknown risks, uncertainties and other factors that may cause actual results or

performance to differ materially from those projected. The forward-looking statements

contained in this press release are subject to other risks and uncertainties, including

those discussed in the "Risk Factors" section and elsewhere in the Company's annual

report on Form 10-K for the year ended December 31, 2014 and in subsequent filings

with the Securities and Exchange Commission. Except as otherwise required by law, the

Company is under no obligation to (and expressly disclaims any such obligation to)

update or alter its forward-looking statements whether as a result of new information,

future events or otherwise.

Presenters

3

Eyal Leibovitz

Chief Financial Officer

David Lucatz

Chairman of the Board and CEO

Shai Lustgarten

CEO of Micronet Ltd.

Tali Dinar

CFO of Micronet Ltd.

4

3rd Quarter Overview

■ Quarterly revenue consistent with introduction of new full

connectivity product line

connectivity product line

■ Revenues decreased slightly sequentially compared to Q2

■ Expect >60% sequential revenue growth and positive EBITDA in 4Q15

■ U.S.-based sales team generating substantial interest in A317

product line

product line

■ Strong MRM backlog growth

■ Significant order pipeline for All-In-One solution

■ Focus on large and growing local fleet market

■ Continued diversification of customer base

5

Recent Developments

MRM

■ Partnership with MiX Telematics to provide TREQ 317 rugged Android tablet for

use with the MiX Rovi in-cab display, developed as solution for compliance with

Electronic Logging Device (ELD) Mandate

use with the MiX Rovi in-cab display, developed as solution for compliance with

Electronic Logging Device (ELD) Mandate

■ One of only five companies selected by New York City’s Taxi & Limousine

Commission to participate in “Vision Zero” Vehicle Safety Technology pilot

program

Commission to participate in “Vision Zero” Vehicle Safety Technology pilot

program

Aerospace/Defense

■ $1.85 Million order from Israeli Multinational Aerospace Contractor for

development and production of Mobile Command & Control Centers;

breakthrough product expected to drive growth in A&D division

development and production of Mobile Command & Control Centers;

breakthrough product expected to drive growth in A&D division

Several Key Announcements Following Close of 3Q15

Positive Outlook

6

MRM

■ Local fleet market expected to grow 37% between 2014 and 20161

■ Expect orders for wireless All-In-One products to build

Aerospace/Defense

■ Continued reliance on missile defense systems supports potential demand for

our missile defense offerings

our missile defense offerings

■ Expect significant international demand for new Mobile Command & Control

Centers

Centers

■ Anticipate > 60% sequential revenue growth with positive EBITDA in 4Q2015

■ Continuing strong potential for our systems and products across both

divisions

1 Licht and Associates study (November 20, 2013)

Macro Trends

4Q2015 and Beyond

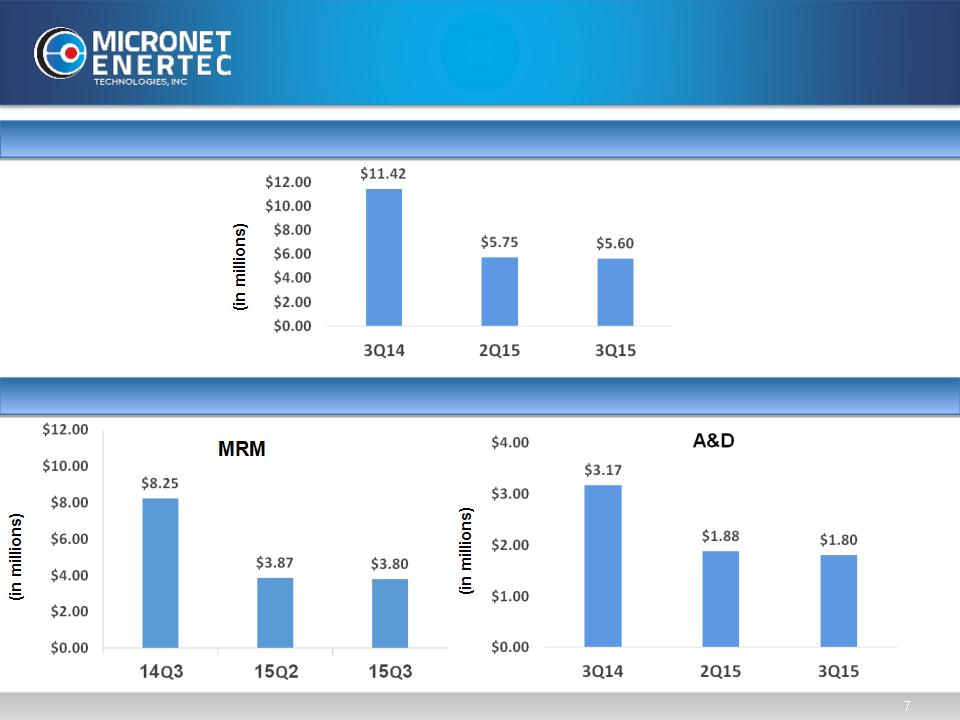

3Q14 vs 3Q15 Revenues

Sales Breakdown

Consolidated revenue for the quarter

8

Next Generation A-317 Tablet

■ A-317 “All-In-One” tablet is a significant technology

advancement

■ Rugged, integrated tablet solution

■ Offers 3.5G/4G LTE, Bluetooth and Wi-Fi applications

■ Potential benefit from upcoming ELD mandate (effective Year End 2015)

First Totally Connected Product; Transforms Product Offering

9

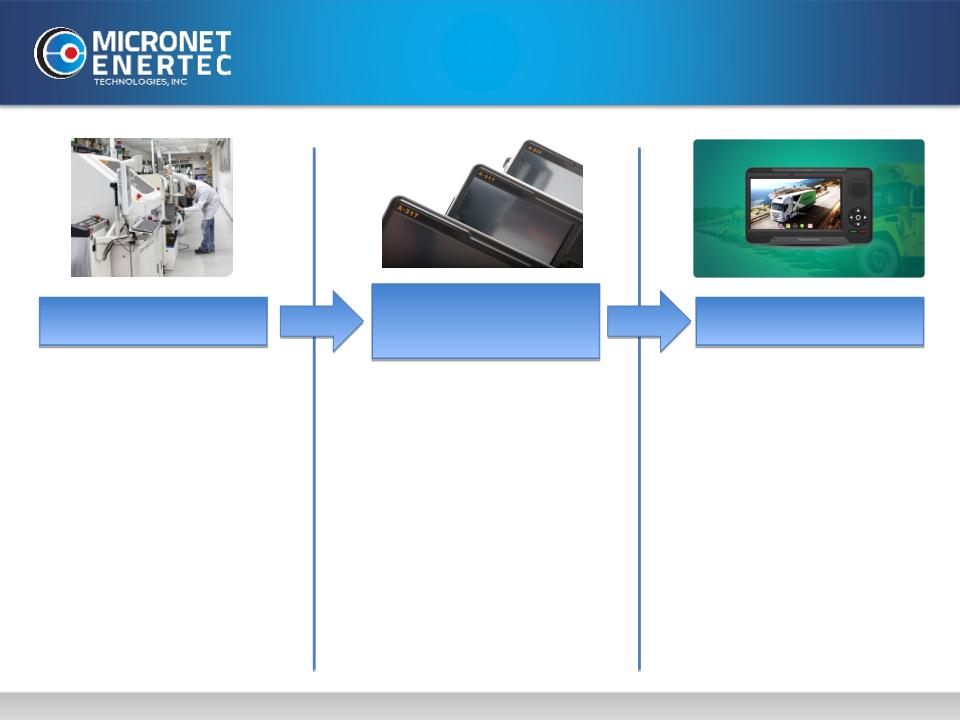

A-317 Tablet Roll Out

Product R&D

Carrier Certification;

Testing & Approval

Adaptation & Orders

● Completed

● Ongoing refinement

with customers

with customers

● Continue to invest

significantly in

product

improvement and

customization

significantly in

product

improvement and

customization

Carrier Certification

● Verizon complete

● AT&T in progress

● In discussions with

additional carriers

Customer Testing/Approval

● Multiple customers

currently testing new

product

● Total of ~16,000 units to

be sold by the end of

the year.

be sold by the end of

the year.

● $1.4M public

transportation

purchase order in July

transportation

purchase order in July

● $950K fleet management

initial purchase order

in June

initial purchase order

in June

● $4M+ school bus

purchase agreement in

May 2015

purchase agreement in

May 2015

10

Income Statement Highlights

(in 000s except share and per share data)

(in 000s except share and per share data)

|

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

||

|

|

2015

|

2014

|

2015

|

2014

|

|

|

|

|

|

|

|

Revenues

|

$ 5,556

|

$ 11,415

|

$ 16,982

|

$ 23,568

|

|

Cost of revenues

|

4,434

|

8,546

|

12,275

|

16,790

|

|

Gross profit

|

1,122 |

2,869

|

4,707 |

6,778

|

|

Gross profit margin

|

20%

|

25%

|

28%

|

29%

|

|

Operating expenses:

|

|

|

|

|

|

Research and development

|

485

|

546

|

1,951

|

2,164

|

|

% of sales

|

8%

|

5%

|

11%

|

9%

|

|

Selling and marketing

|

395

|

449

|

1,214

|

1,209

|

|

% of sales

|

7%

|

4%

|

7%

|

5%

|

|

General and administrative

|

1,169

|

1,738

|

3,407

|

4,219

|

|

% of sales

|

21%

|

15%

|

20%

|

18%

|

|

Amortization of intangible assets

|

282

|

306

|

889

|

557

|

|

Total operating expenses

|

2,331

|

3,039

|

7,461

|

8,149

|

|

% of sales

|

42%

|

27%

|

44%

|

35%

|

|

|

|

|

|

|

|

Net income (loss) attributable to MICT

|

(1,263)

|

(506)

|

(2,557)

|

(2,111)

|

|

Basic and diluted income (loss) per share

|

(0.22)

|

(0.09)

|

(0.44)

|

(0.36)

|

|

Weighted average common shares outstanding:

|

5,865,221

|

5,831,246

|

5,838,873

|

5,831,246

|

Non-GAAP

(in 000s except share and per share data)

(in 000s except share and per share data)

11

|

|

Three Months Ended

September 30,

|

Nine Months Ended

September 30,

|

||||||

|

|

2015

|

|

2014

|

2015

|

|

2014

|

||

|

GAAP net loss attributed to MICT

|

|

(1,263)

|

|

(506)

|

|

(2,557)

|

|

(2,111)

|

|

Total amortization of acquired intangible assets

|

|

177

|

|

212

|

|

558

|

|

348

|

|

Change in fair value of call options and warrants

|

|

0

|

|

0

|

|

0

|

|

307

|

|

Amortization of UTA's note discount and related

expenses |

|

0

|

|

6

|

|

0

|

|

61

|

|

Stock-based compensation

|

|

82

|

|

6

|

|

254

|

|

19

|

|

Expenses related to the purchase of business

|

|

0

|

|

79

|

|

-

|

|

369

|

|

Income tax-effect of above non-GAAP adjustments

|

|

(7)

|

|

(11)

|

|

(24)

|

|

(26)

|

|

Total non-GAAP net income (loss) attributed to

MICT |

|

(1,011)

|

|

(214)

|

|

(1,769)

|

|

(1,033)

|

|

Non-GAAP net income (loss) per diluted share

|

|

(0.17)

|

|

(0.04)

|

|

(0.30)

|

|

(0.18)

|

|

Shares used in per share calculations

|

|

5,865,221

|

|

5,831,246

|

|

5,838,873

|

|

5,831,246

|

|

GAAP net income (loss) per diluted share

attributable to Micronet Enertec Technologies, Inc. |

|

(0.22)

|

|

(0.09)

|

|

(0.44)

|

|

(0.36)

|

|

Shares used in per share calculations

|

|

5,865,221

|

|

5,831,246

|

|

5,838,873

|

|

5,831,246

|

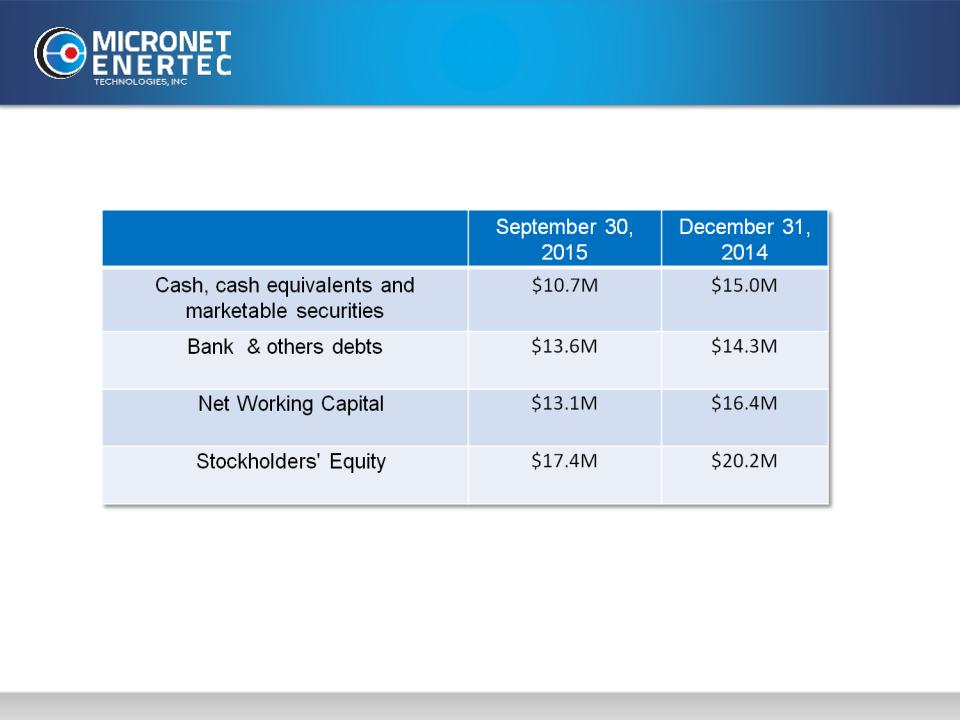

Strong Balance Sheet

12

.

ELD Mandate Opportunity

13

New regulation starting in 2017 mandates all truck drivers to keep records of

hours of service (HOS).

hours of service (HOS).

● Cannot drive over 11 hours per day.

● Required rest periods.

Electronic Logging Devices (ELDs)* connect to engine and replace paper

logbooks.

logbooks.

Law being put in place requiring ELDs.

* Federal Motor Carrier Safety Administration:

“Electronic Logging Devices and Hours of Service Supporting Documents”- March 2014

July ‘12

Passed by

congress

congress

2017

Law enforced

2015

Law enacted

June ‘14

Comment period

closed

closed

2015 500,000 ELD equipped trucks

2017 ~2.6 Million trucks will require ELD

Our tablets are fully compliant with the regulation

requirements

requirements

Thank You

14

Q & A